Storage Market Rises Strongly: Prices Surge Across Categories as Supply-Demand Shifts

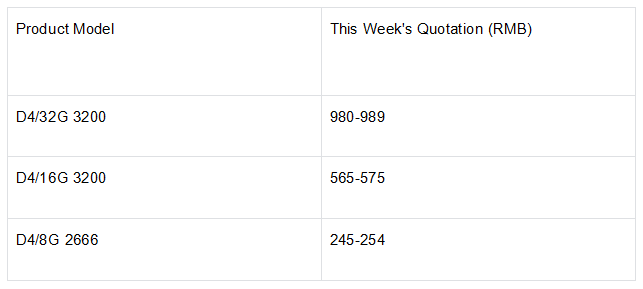

The DRAM market’s upward momentum shows no sign of abating. OEMs have allocated over 75% of production capacity to prioritize AI/cloud clients, sharply reducing supply in traditional channels. While demand for finished modules in the domestic PC assembly market is soft (with some vendors downsizing capacities to adjust), industrial and laptop sectors see strong demand. Key price movements for major DRAM products:

Flash Wafer markets witnessed a dramatic price surge, with 32G TLC OEM contract prices jumping 45.45%. The market has entered an intense “shuffling” phase, as module manufacturers continue purchasing despite cost inversion to secure supplies, retain clients, and maintain market share. Embedded storage product prices have risen sharply due to cost pressures.

The USB market stayed stable this week, with modest demand and limited chip supplies. For TF cards, small-capacity variants held steady while large-capacity models rose 2%-6%, prompting some traders to cash out at high prices. PCBA prices were flat except for 16G (down 3%), and UDP prices rose only for 32G (up 2%).

Current market polarization is evident: OEMs are shifting resources to high-profit segments, with new capacity from Samsung, SK Hynix, Micron, and SanDisk not expected until 2026-2028. Downstream module makers and distributors face “expensive purchases and difficult shipments” amid year-end settlements. Overall, supply-side pressures persist, buyers remain cautious, and transactions are dominated by rigid demand. Short-term high volatility is likely to become the new normal for the storage market.