Storage Market Continues to Rise: NAND and DRAM Prices Increase Simultaneously, with National Day Peak Season Demand Boosting Price Expectations

This week, the storage market continued its upward trend from last week, with NAND Flash and DRAM prices rising in tandem. Driven by the “buy when prices rise, not fall” psychology, coupled with expectations for the National Day and Mid-Autumn Festival peak consumption season, market purchasing sentiment has significantly warmed up. The game between channel vendors’ reluctance to sell at low prices and end-users’ demand for restocking has further pushed prices to move steadily upward.

NAND Market: OEM Supply Control + Supply-Demand Imbalance

Samsung and Micron have clearly planned to increase NAND prices by 20%-30%, while SK Hynix is also formulating a follow-up plan. Some manufacturers have even suspended quotations for 2026 to re-evaluate the supply-demand relationship. Institutions predict that prices will see a double-digit increase in the fourth quarter, and will rise by another 15%-20% in the first half of 2026.

In the SSD market, upstream wafer prices have continued to rise, and channel inventory has entered the final stage. Typhoons and the upcoming long holiday have affected logistics and transportation, leading to tight supply. As a result, channel vendors are generally unwilling to ship at low prices.

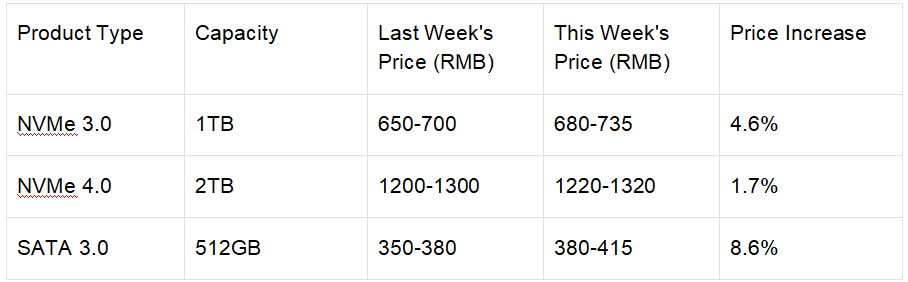

This Week's SSD Market Price Trend

DRAM Market: Full Production Capacity Still Fails to Meet Demand

To address the shortage, Samsung’s wafer output in the third quarter is expected to reach 1.93 million units, and is likely to exceed 2 million units per quarter next year; SK Hynix’s quarterly input volume has remained stable at around 1.5 million units this year, and will approach its maximum production capacity of 1.6 million units by the end of the year.

However, it takes time to release production capacity, making it difficult to ease the short-term supply gap. The prices of spot server memory chips have continued to rise, with no sign of a decline.

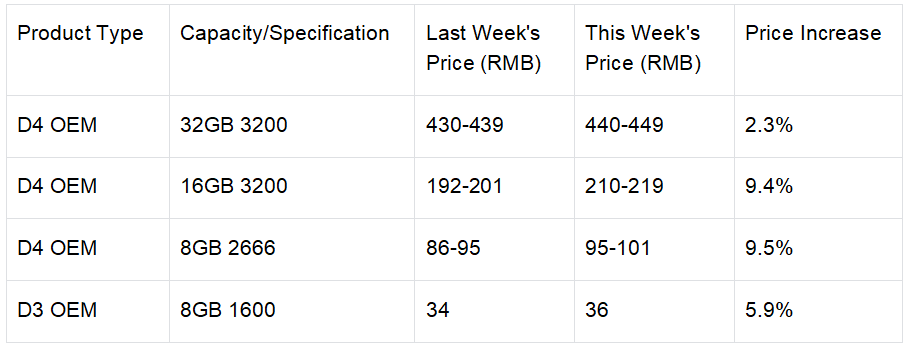

This Week's DRAM Market Price Trend

Flash Chips and USB/TF Card Market

The contract prices of Flash Wafer from OEMs have risen sharply, and spot market prices have increased by 15%-20%, with market sentiment of chasing price increases heating up. Some manufacturers are waiting and seeing or testing the market bottom line, making price fluctuations more volatile.

Quotations in the USB market have continued their upward trend. Driven by rising chip prices and increasing orders ahead of the National Day, the TF card market has also continued to rise. With OEM wafer prices climbing, the industry suggests appropriate stockpiling.

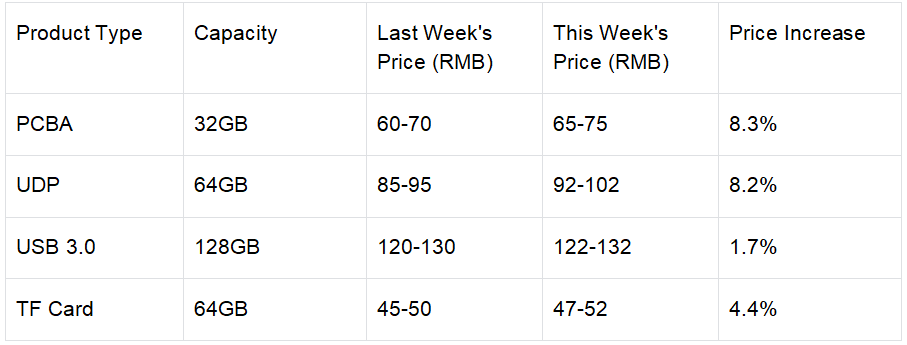

This Week's USB and TF Card Price Trend