Global Storage Market Warms Up: Apple and AI Emerge as Key Drivers of Price Growth

This week, the global semiconductor market has shifted direction, and the storage industry has simultaneously received positive signals. After a short correction, the memory market has started to rebound, while the flash memory market has also shown signs of recovery. Combined with the launch of Apple’s new products and the continuous heating up of the AI wave, the upward trend in storage product prices for the fourth quarter has gradually become clear.

From the perspective of the overall market, SSD products took the lead in registering a slight price increase in the third quarter, laying the foundation for a price rise in the fourth quarter. Currently, DRAM prices remain at a high level, upstream SSD manufacturers have released signals of price adjustments, Flash Wafer spot prices have risen, and USB product prices have increased slightly. Multiple product categories are seeing synchronized bullish trends, and industry players are optimistic about the market outlook. However, industry insiders also remind that although the overall market trend is positive, it is still necessary to closely monitor changes in demand and manage risks properly.

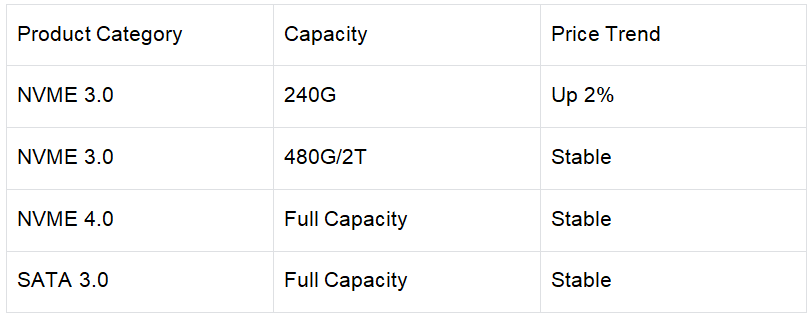

In terms of segmented markets, the overall price of the SSD market remained stable this week, with only mild signals of price adjustments from upstream. Nevertheless, FLASH memory wafers have started to see price increases, and discounted resources in the market have been almost exhausted. The specific price trends of SSD products are shown in the table below:

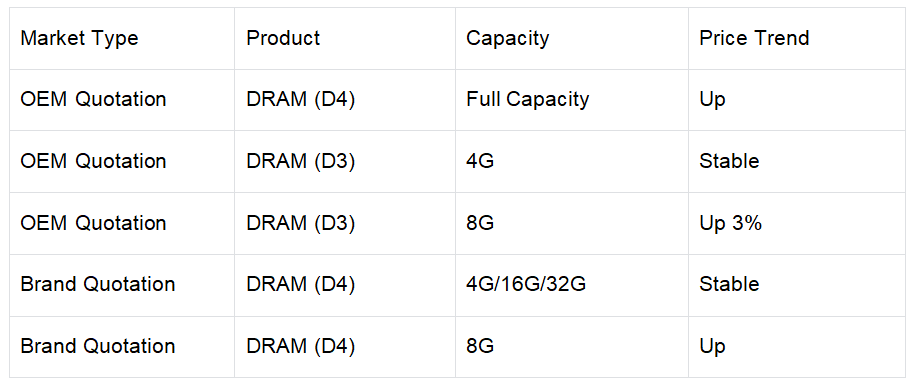

The DRAM memory market, after a short correction, has entered a rebound and upward phase, with strong bullish sentiment in the market. Increased inquiry activity from customers has driven a recovery in demand, but due to the high price of finished memory modules, there is a gap between customers’ expected prices and the actual quoted prices, leading to resistance in actual transactions. Industry insiders suggest that market participants should operate cautiously. The specific price trends of DRAM products are as follows:

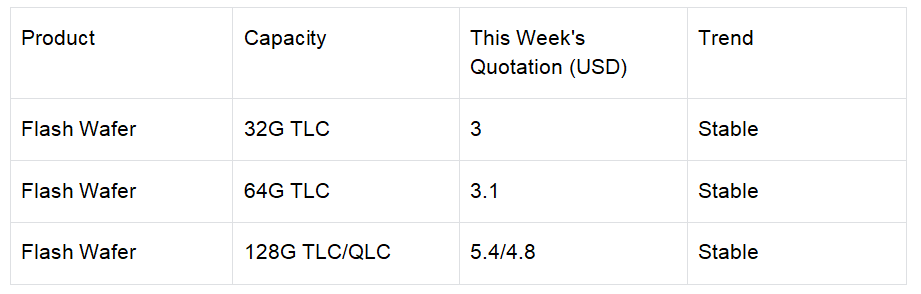

In the Flash chip market, contract prices from original manufacturers remained stable, while spot prices rose slightly. Currently, spot inventory is decreasing, and bullish sentiment in the market is strong. In terms of resource allocation, demand for enterprise-level SSDs and high-capacity QLC chips has been given priority, squeezing the supply for the consumer segment. Many original manufacturers still maintain prices by controlling production. It is recommended that industry players can appropriately increase their positions. The specific quotations are shown below:

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

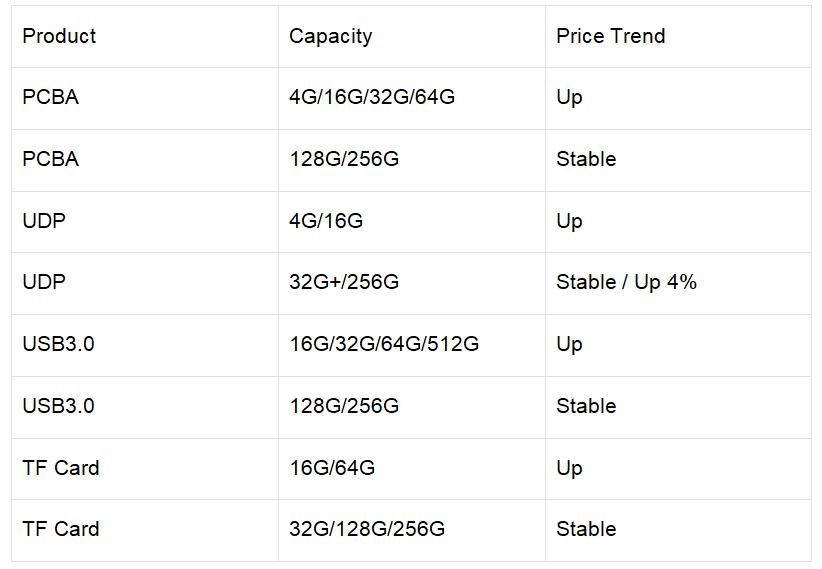

The USB and TF card markets also showed positive performance this week, with prices rising slightly and an increase in customer inquiries. Driven by the price increase of Flash chips, traders have strengthened their willingness to stock up, and distributors are optimistic about the market outlook, currently maintaining a reasonable inventory level. The specific price trends are as follows:

In terms of industry focus, Apple’s new product launch event has become a key event recently. The iPhone 17 has set 256GB as the starting storage capacity, further promoting the development of storage products towards larger capacities. In the supply chain, Samsung Electronics, SK Hynix, Micron Technology, and other companies have all entered the list of suppliers for the iPhone 17, among which Samsung and SK Hynix are the core suppliers, accounting for more than 50% of the share. At the same time, SK Hynix has received a series of positive news recently: in addition to maintaining its position as a core supplier in Apple’s supply chain, it also launched the industry’s first mass-produced high-performance NAND solution product ZUFS 4.1 for mobile devices. These multiple positive factors have driven its stock price to a record high. In addition, module manufacturer ADATA and controller manufacturer Phison Electronics also reported significant growth in performance, with both orders and shipments increasing. Domestic storage manufacturers have also been active: Yangtze Memory Technologies Co., Ltd. (YMTC) Phase III was officially established with a registered capital of 20.7 billion yuan. Notably, no major funds were introduced this time, and Hubei Changsheng Phase III Investment contributed more than 10 billion yuan, demonstrating the support of local capital for the storage industry.

The continuous heating up of the AI wave has also brought long-term impetus to the storage industry. Recently, Oracle signed a huge $30 billion order with OpenAI, and Broadcom has also gained favor from many customers. Both companies have been sought after by investors in the capital market, with Oracle’s stock price surging by nearly 40% overnight. The vigorous development of the AI industry is providing important support for the growth of demand in the storage industry.