DRAM Manufacturers’ Collective Production Cuts Trigger DDR4 Shortage, Driving Industry Shift to Advanced Processes

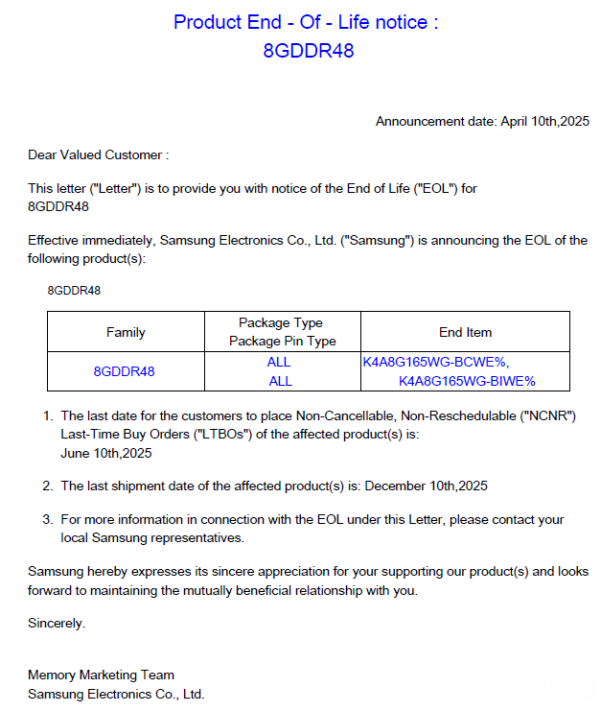

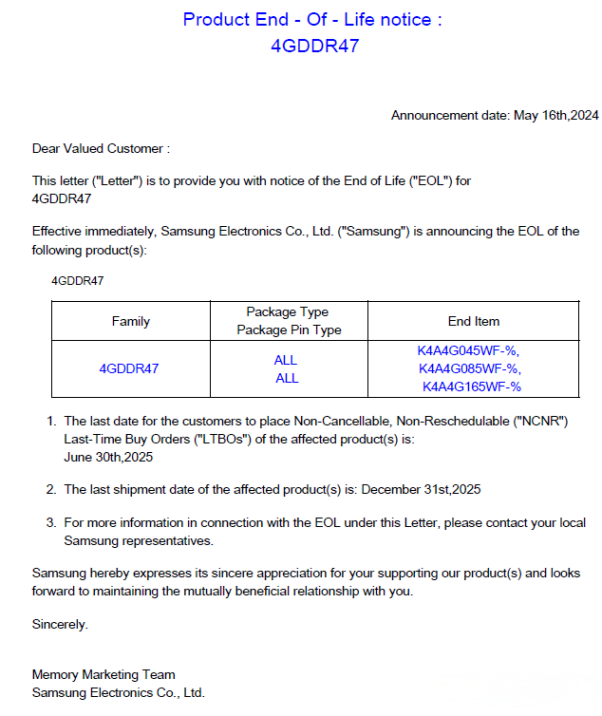

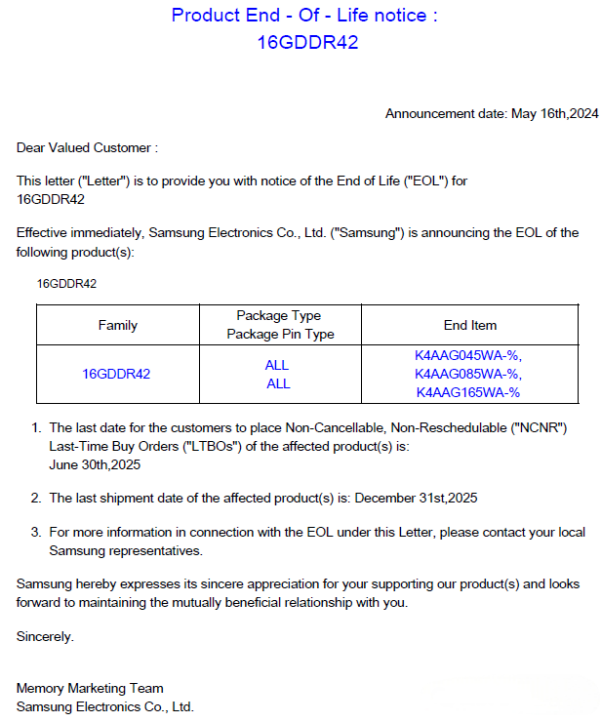

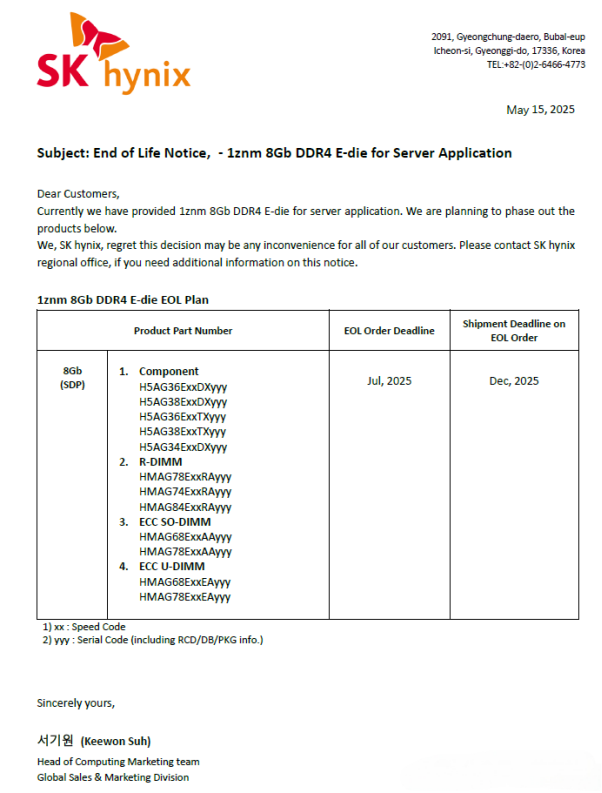

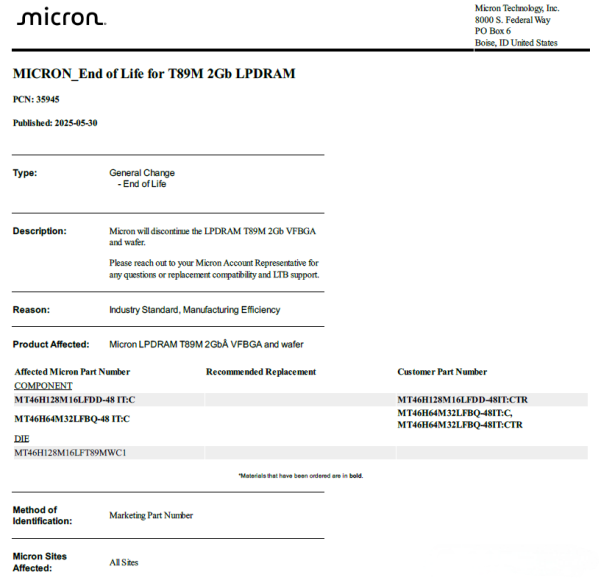

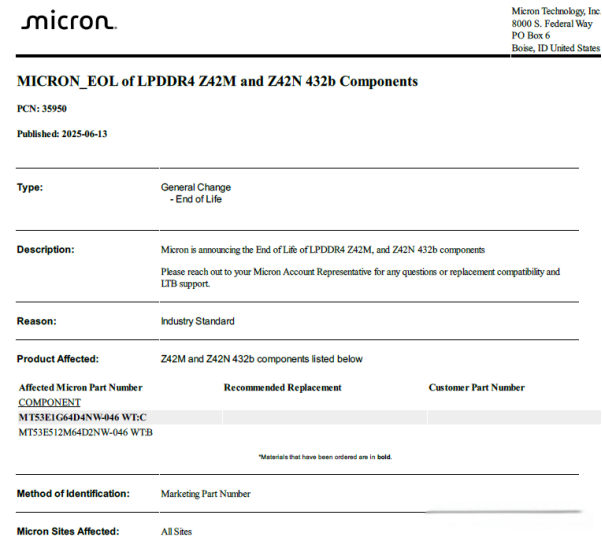

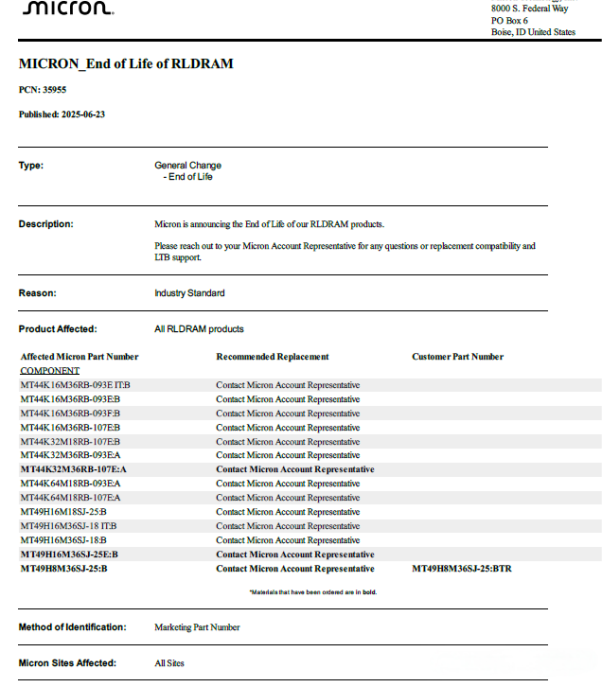

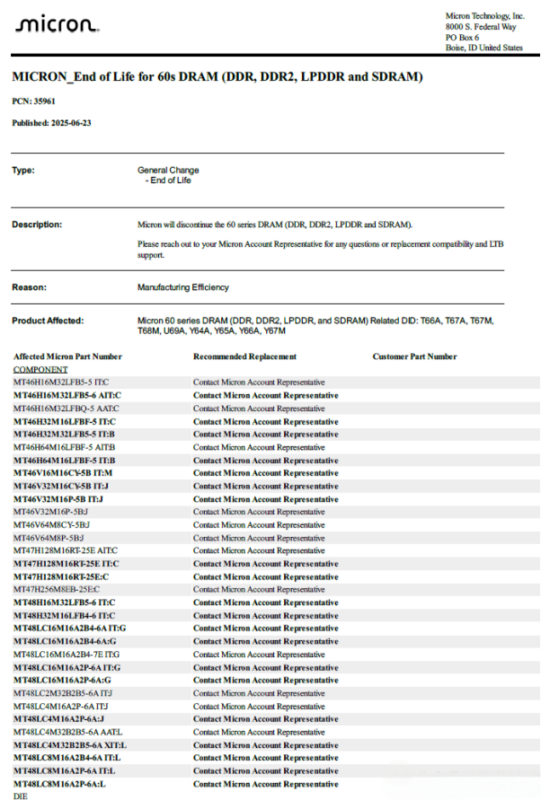

Since 2025, global DRAM manufacturers, including Samsung, SK Hynix, and Micron, have successively announced plans to phase out the production of DDR4 memory using older manufacturing processes. They intend to gradually halt the supply of consumer – grade and server – grade DDR4 within the next two to three quarters, maintaining only limited shipments for long – cycle sectors such as automotive and industrial applications. This strategic move stems from the manufacturers’ focus on allocating more production capacity to advanced processes (1a/1bnm), in a bid to support the research, development, and production expansion of HBM and DDR5 technologies driven by AI. As a result, the bit output ratio of DDR4 for some manufacturers has dropped to single – digit percentages in the third quarter.

The contradiction between the shrinking supply and resilient demand for DDR4 continues to intensify. On the supply side, the transition of older production lines is irreversible. 8Gb DDR4 chips have become a critical shortage item because DDR5 (starting from 16Gb) and DDR3 (with insufficient capacity) cannot serve as substitutes. Additionally, the lead time for key materials like packaging substrates has extended to 16 – 20 weeks, significantly increasing the delivery pressure for low – capacity LPDDR4X products (2/3/4GB). On the demand side, consumer electronics sectors such as mobile phones and PCs still rely on DDR4. For instance, the supply gap for LPDDR4X in mobile phones reaches 15% – 20%. In industrial and automotive applications, due to long certification cycles, more than 80% of the demand remains for DDR4. Coupled with panic buying in the market, the prices of some DDR4 chips doubled in the second quarter, and contract prices are expected to increase by another 30% – 40% in the third quarter.

Technological iterations are reshaping the market landscape. The surging demand for HBM3e, driven by AI servers, enabled SK Hynix to surpass Samsung in DRAM sales for the first time in the first quarter of 2025. The three major manufacturers are accelerating the transition to advanced processes such as 1b/1γ, as well as to LPDDR5X and HBM4. In the PC market, DDR4 contract prices are expected to soar by 30% – 40%, while DDR5 prices will experience moderate growth. This has led to increased price negotiations between manufacturers and customers.

Industry insiders point out that the DDR4 shortage is forcing end – users to shift to DDR5/LPDDR5X. Driven by the demand for AI computing power and technological upgrades, the DRAM industry is rapidly transforming towards advanced processes that offer high performance, large capacity, and high profit margins. The focus of market competition is gradually shifting to next – generation storage technologies such as HBM.