AI-Driven Demand Triggers Comprehensive Price Hikes and Shortages in the Storage Market

This week, the upward trend in storage market prices continues to escalate, with core products such as DRAM, NAND Flash, SSD, and HDD facing widespread shortages and rapid price increases. This phenomenon is mainly driven by the surge in AI demand. Taking GPT series models as an example, the new global user requests for GPT-5 in 2025 will account for 25% of the global DRAM supply and 22% of the NAND supply; if the demand doubles in 2026, these proportions will rise to 43% and 39% respectively, absorbing the newly added global storage production capacity. Currently, the inventory levels of the top three upstream original equipment manufacturers (OEMs) are at a low point, the supply-demand gap is widening, the market structure is shifting to supply dominance, and the bargaining power of end – stage manufacturers is weakening.

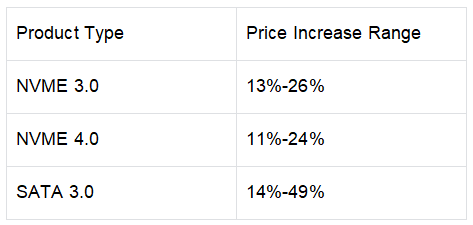

In the SSD market, prices have risen significantly this week. The increase in wafer contract prices has pushed up costs, and due to limited spot supplies, OEMs are prioritizing the delivery of early orders, leading to the suspension of quotations in some markets. Coupled with the low inventory levels in the early stage and the demand for stockpiling for the Double 11 shopping spree, a short – term correction is unlikely. Quotations for both NVME and SATA series are on the rise, with specific price increase ranges as follows:

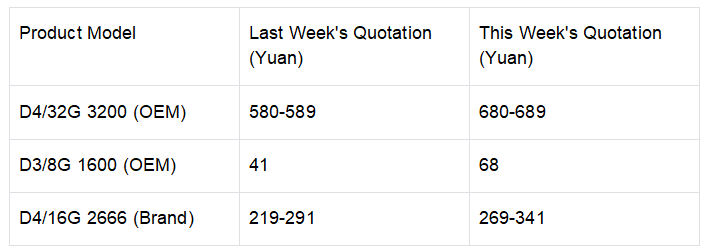

The DRAM market has witnessed the largest single – week price increase this year, and merchants often encounter situations where “prices rise within an hour” when purchasing goods. In the quotations of OEMs and brands, all capacity segments of the D3 and D4 sectors have seen price increases, with the price increase of D3 reaching 43%-66%. The specific quotation changes of some products are as follows:

In addition, the transaction price in the Flash chip market has a premium of over 20% compared with the contract price, and all traders have entered the market; the USB and TF card markets have seen continuous price strength due to the production control by original manufacturers and the stockpiling demand for the peak season, with the price increase of UDP products reaching 30%-47%.

At present, the tight supply in the storage market and the excessive price increases have intensified the demand contradiction, and the speculative sentiment is strong. If original manufacturers continue to control production and limit supply, high – level price consolidation may become the norm. The market reminds that the prices of various products fluctuate rapidly, and the actual transaction prices are subject to real – time quotes. Enterprises need to pay close attention to market dynamics, make reasonable stockpiling plans, and adjust their business strategies in a timely manner.