AI Demand Ignites Storage Market: SSD/DRAM/Flash Prices Surge Across the Board, Major Manufacturers Hike Prices by 20%-30% Thro

Driven by the explosive growth in data storage demand fueled by the accelerated development of artificial intelligence (AI) applications, the global storage market has fully entered a price hike cycle this week. According to industry analysis, insufficient upstream production capacity, low inventory levels, coupled with production cuts by original equipment manufacturers (OEMs) and supply chain adjustments, have collectively pushed up the prices of various storage products such as SSDs, DRAMs, and Flash memory. Major manufacturers have also announced clear price increase plans, and the upward price trend is expected to continue until 2026.

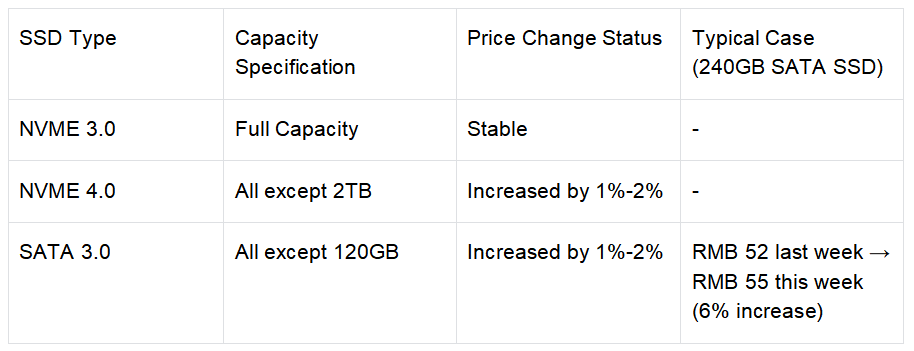

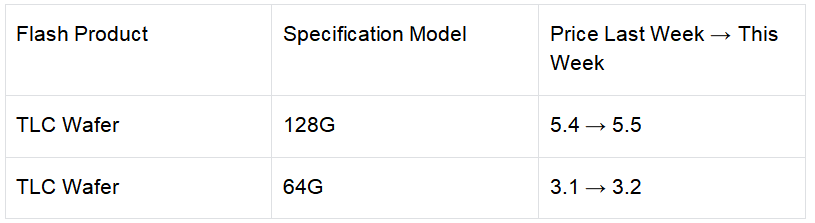

In the SSD sector, SanDisk and Micron have taken the lead in adjusting prices. The market expects Kioxia and Samsung to follow suit in the fourth quarter, with potential price increases of 10%-15%. Enterprise-grade SSD demand has surged due to extended delivery times for HDDs, while consumer-grade products have seen widespread price hikes driven by cost pass-through. Specific price changes are shown in the table below:

The supply-demand imbalance in the DRAM market has further worsened. Prices of server-grade chips and finished memory modules have hit a new high this year, with high-frequency, large-capacity products becoming hot items in market transactions. Industry institutions predict that DDR4 products may face shortages until the fourth quarter of 2026. Price changes in OEM and brand-level quotations are as follows:

Major manufacturers have made particularly clear moves to raise prices: Micron has officially notified distributors that the prices of its storage products will increase by 20%-30%; Samsung expects DRAM contract prices to rise by 15%-30% and NAND-based products by 5%-10% in the fourth quarter. Notably, the production capacity of DDR4-related products will shrink significantly in the future, with 2026 capacity expected to be only 20% of that in 2025, further intensifying supply pressure in the market.

As North American CSP (Cloud Service Provider) clients increase their investment in AI infrastructure, storage resources are being prioritized for leading enterprises, leaving small and medium-sized distributors facing greater pressure in stockpiling and higher cost risks. Industry insiders analyze that this round of price hikes is driven by both supply-demand structural factors and technological iteration, and is expected to continue until 2026.