Storage and Chip Industry Blossoms on Multiple Fronts: DDR4 Price Hikes, SK Hynix Hits New Highs, and Strong Performance from Major Manufacturers

Recently, the global storage and chip industry has been receiving multiple positive signals. DDR4 storage prices have been rising steadily, stock prices of leading enterprises like SK Hynix have hit new highs, and the performance of manufacturers such as Phison and MediaTek has also been impressive. The industry as a whole is showing a warming and positive trend.

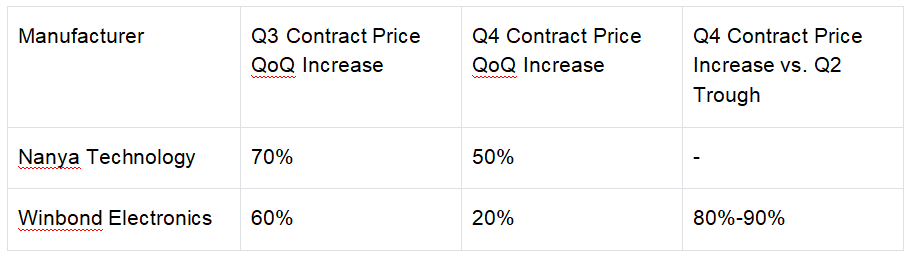

In the storage market, DDR4 products have become the main driver of price increases. With the arrival of the traditional peak season in the electronics industry in the second half of the year, coupled with storage manufacturers controlling production capacity, market supply has become tight. Following the price increase in the third quarter, DDR4 is expected to achieve a quarterly increase of 20%-50% in the fourth quarter. Among them, two manufacturers, Nanya Technology and Winbond Electronics, have performed particularly prominently. The specific increases are shown in the table below:

Institutions predict that these two manufacturers are expected to turn losses into profits ahead of schedule. At the same time, the global storage industry is accelerating its iteration towards DDR5 and HBM, and DDR4 production is gradually being phased out. By the fourth quarter of 2026, the global DDR4 production capacity is expected to be only 25-33% of that in the first quarter of 2025. However, budget mobile phones, some consumer electronic products, as well as industrial control and automotive markets still have high demand for DDR4, creating a supply-demand gap. Nanya Technology and Winbond Electronics have increased their DDR4 production capacity, and their market share is expected to rise significantly in 2026, challenging the dominant position of South Korean manufacturers in the DDR4 field.

Good news has also come from the stock prices of leading storage enterprises. On the morning of the 11th, SK Hynix’s trading price on the KOSPI market was 312,000 won, an increase of 2.63% compared with the previous trading day. During intraday trading, it once climbed to 315,000 won, setting a record high since its merger into the SK Group. Samsung Electronics reported a price of 73,000 won, an increase of 0.55% from the previous trading day, and once rose to 73,600 won at the opening, approaching the annual high of 74,000 won. This positive trend is closely related to the market’s expectation of a renewed upsurge in AI sector investment. The backlog of unfulfilled orders of U.S. software company Oracle surged by 359% year-on-year, driving a rebound in U.S. semiconductor enterprises including NVIDIA. Institutions predict that not only HBM, a key component of AI chips, but also NAND may face a shortage of supply, and the NAND storage industry may enter a phase of supply shortage starting from 2026.

In terms of manufacturers’ performance, both Phison and MediaTek have delivered outstanding results. Phison’s consolidated revenue in August reached NT5.934 billion, a month-on-month increase of 4% and a year-on-year increase of 23%, setting a record high for the same period in history. The cumulative revenue from January to August this year reached NT43.35 billion, a year-on-year increase of 3.4%, also refreshing the historical record for the same period. In August, the shipment volume of its PCIe SSD controller chips increased by 49% year-on-year, the shipment volume of mobile device storage controller chips soared by 105% year-on-year, and the shipment volume of NAND also increased by 20% year-on-year.

MediaTek’s consolidated revenue in August was NT44.55 billion, a year-on-year increase of 7.3% and a month-on-month increase of 3.1%. The cumulative revenue from January to August was NT391.45 billion, a year-on-year increase of 12.5%. In terms of products, the revenue contribution of its flagship mobile phone chips is expected to reach US$3 billion this year. On September 22, MediaTek launched the Dimensity 9500 chip, which has entered the mass production stage and adopts TSMC’s third-generation 3nm technology. The design of its first 2nm chip was finalized this month. In addition, MediaTek has also carried out cooperation with NVIDIA and Arm, and has long-term growth potential in fields such as ASIC and automotive electronics. The ASIC project will gradually expand production capacity at the end of the fourth quarter.

At the same time, SK Hynix has also launched the industry’s first mass-produced high-performance NAND solution product for mobile devices, ZUFS 4.1, to customers. Mass production of this product was fully launched in July, which can significantly improve data transmission speed and power efficiency. When applied to smartphones, it can reduce the problem of degraded reading performance, shorten the application startup time and AI application execution time, and bring innovative experiences to users.