Storage Market Divergence Intensifies: DRAM Price Uptrend Continues as SSDs Plunge into Price Wars, Chip Capital Market Heats Up

This week, the storage market shows a significant divergent pattern. While the DRAM market continues its upward price trend, the SSD market has fallen into a fierce price war. Meanwhile, the domestic chip-related capital market has performed actively, making industry developments a focus of attention.

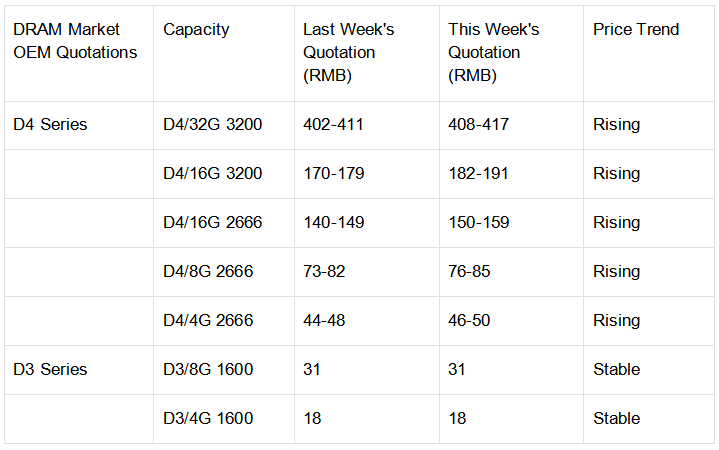

The DRAM market has seen a notable upward trend, with spot particles registering prominent price increases and prices showing an inverted trend. Merchants have low acceptance of finished memory module prices, but there is strong enthusiasm for speculation in spot varieties such as server particles. Market supply is tight, and the prices of some types of particles have exceeded the levels in mid-to-late June. Holders have a strong bullish expectation for the future market. In terms of quotations, all capacities in the D4 segment of the OEM market have increased, with a price rise of 2%-7%, while the D3 segment remains stable.

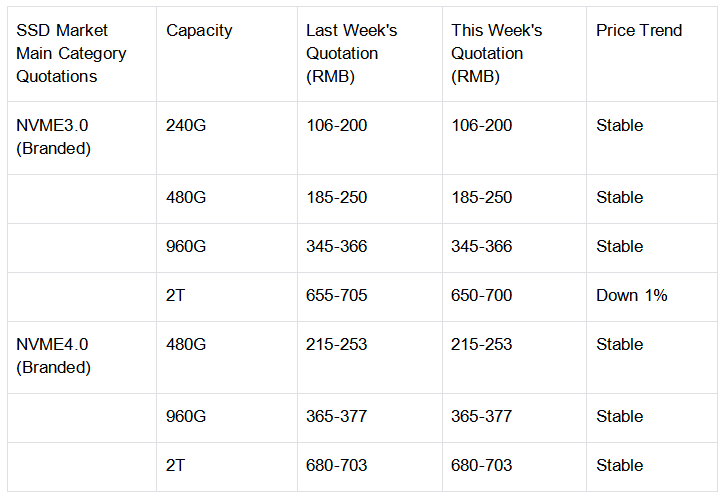

In contrast, the SSD market suffers from weak demand and maintains a volatile trend. Although normal quotations are maintained externally, the actual transaction prices are generally low, with severe price cutting. Some general agents are forced to reduce prices for capital turnover due to inventory and cash flow pressures. Affected by the general economic environment, consumers have low purchasing willingness, and the replacement cycle has been extended. The market has not improved even as the new school season approaches. In terms of quotations, only the 2T capacity of NVME3.0 has decreased by 1%, while other capacities, as well as all capacities of NVME4.0 and SATA3.0, remain unchanged.

In addition, the contract prices of Flash Wafer original manufacturers have been partially increased, but the demand in the mainland market is weak. The USB and TF card markets are generally stable, with demand lower than that of previous years. In the capital market, Kaipu Cloud’s stock price rose by the 20% daily limit for three consecutive days after acquiring the established storage manufacturer Jintai Ke, and chip manufacturers such as SMIC (Semiconductor Manufacturing International Corporation) have performed brilliantly. At this week’s Embedded Electronics Exhibition, storage manufacturers concentrated on displaying new products to seek market breakthroughs. Looking at the half-year performance of domestic module manufacturers, the overall performance in the first half of the year was not good, but there was a slight rebound in the second quarter.