Intensified Turbulence in the Storage Market This Week with Significant Price Fluctuations Across Multiple Categories

This week, the storage market has shown obvious turbulence due to the dual impacts of tight supply of upstream materials and issues with Microsoft’s system update. The surge in demand for AI servers has led to a shortage of substrate materials, straining the packaging and testing. The delivery time for BT substrates in the third quarter has been extended, and even delivery dates are no longer promised, resulting in an inverted price of DDR4 memory with a maximum increase of 25%, putting significant cost pressure on downstream manufacturers.

Meanwhile, the Windows 11 August update has caused some SSD models to experience disk drop issues under specific conditions. Although no large – scale outbreak has occurred, it has intensified the wait – and – see mood in the market, and relevant manufacturers have launched an investigation together with Microsoft.

The three major original manufacturers are focusing on HBM business, and the competitive pattern of the HBM4 market is beginning to take shape: SK Hynix is expected to account for 50% of the market share, Samsung 30%, and Micron 20%. Samsung’s HBM4 has passed NVIDIA’s verification and is scheduled to enter pre – production at the end of August. The 8TB version of the 9100 Pro PCIe 5.0 SSD has been launched, boosting market confidence. It is expected that the sales of HBM will increase by 105% year – on – year next year.

The capital market has performed actively. Chip stocks have driven the rise of storage – related stocks, and the Shanghai Composite Index has broken through the nearly decade – high to 3760 points. Some companies have taken the opportunity to reduce their holdings, and funds have been unwound and withdrawn. Nanya Technology, a module manufacturer, raised the average price of DDR4 orders in August by 11% – 16%, becoming a major beneficiary. It is expected that the supply gap of DDR4 will widen to 10% – 15% in the second half of the year.

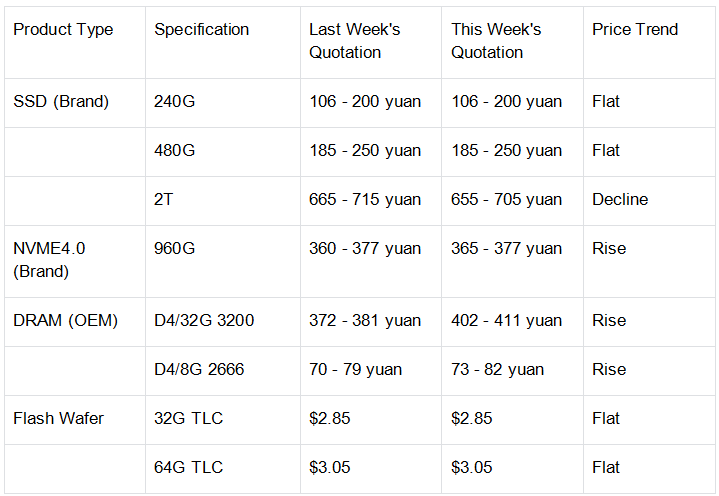

The following is the market quotation of major storage products:

Among specific categories, DRAM prices continue to rise, with a shortage of large – capacity particles; SSD prices are sideways and declining, with unsatisfactory demand; the USB market demand has improved, mainly focusing on shipments; and the TF card market remains sluggish. As the school season approaches, the strength of peak – season stockpiling is limited. The industry suggests paying attention to changes in supply chain costs, adjusting procurement strategies in a timely manner, and being cautious in investment.