Domestic Storage Market Differentiation: DRAM Continues to Thrive, SSD Remains in Adjustment Period

This week, the domestic storage market showed obvious differentiation. DRAM product prices rose slightly, with both orders and transaction volumes increasing; the SSD market, on the other hand, maintained an adjustment trend, with weak demand and a strong wait – and – see atmosphere. Changes in the global economic environment and industrial policies have further intensified expectations of adjustments in the market structure.

At the global trade level, Sino – US trade tariffs have been extended for another 90 days, but the news that the United States plans to impose a 100% tariff on semiconductors has attracted attention. However, manufacturers such as Samsung, SK Hynix, and Micron that have built factories in the United States are exempted. In contrast, NVIDIA and AMD need to hand over 15% of the profits from products sold to China to the U.S. government. The increased costs may push up product prices. Against this background, compliance is gradually becoming the norm in the market. Shande Information reminds participants to standardize their layouts in advance.

There have been frequent developments among original manufacturers and module manufacturers: Micron announced large – scale layoffs in China, terminated mobile NAND development, and focused on DRAM; Baiwei Storage was reduced by 2% by the National Big Fund, and Kingtiger is likely to be acquired by Kaipu Cloud. At the same time, the popularity of the domestic stock market has diverted market attention. The stock market rose on Wednesday this week, hitting a new high since last October, which to some extent affected the willingness to trade in the storage spot market.

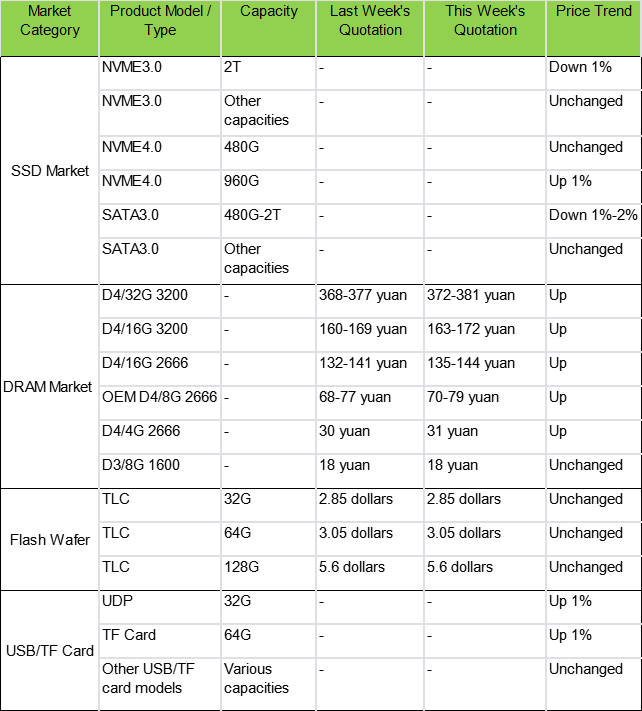

In terms of specific products, the DRAM market performed well, with prices rising slightly, and the number of inquiries and transaction volumes increasing month – on – month. Prices remained high, but due to the gap between customers’ psychological prices and quoted prices, their motivation to stock up was insufficient, and transactions were mainly based on “dealing with orders and maintaining cash flow”. The SSD market, however, has weak demand. The traditional peak season in September may bring a turning point, but it is not advisable to be overly optimistic at present, and it is recommended to maintain a reasonable inventory turnover.

The contract prices of Flash Wafer original manufacturers remained stable, but traders lowered prices to accelerate turnover. The consumer – level market transactions were unsatisfactory, and enterprise – level SSDs became the main growth driver. The USB market was stable with average demand; TF cards showed differentiation, with low – capacity ones under price pressure and high – end ones showing growth.

Weekly Price Change Data Sheet of Storage Products